VA Disability Compensation and Disability Pension

Veteran’s Disability Compensation

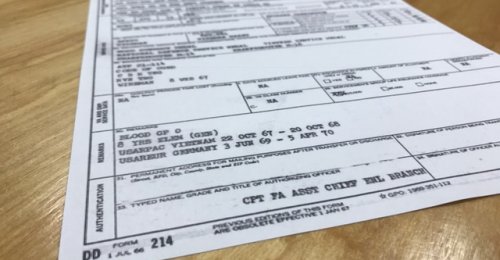

Veteran’s Disability Compensation is administered by the Department of Veterans Affairs and is intended to compensate veterans for loss of quality of life and civilian employability. To qualify, an individual must be a veteran. The VA defines a veteran as “a person who served in the active military, naval, or air service, and who was discharged or released therefrom under conditions other than dishonorable.” A reservist must be injured in the line of duty during a period of active duty or training in order to meet the requirement of service.

If you meet these requirements, you must then demonstrate:

- A medical diagnosis of the current disability;

- Medical evidence of an in-service injury; and

- A connection between the injury and your disability.

The VA will issue a disability rating if they find that the above requirements are met based upon criteria set forth in the VA Rating Schedule. If you are claiming more than one injury, the VA will combine your rating scores for all injuries using a Combined Ratings Table to arrive at a total disability rating. Like the DoD, the VA assigns disability ratings in 10 point intervals. Unlike DoD ratings, a VA disability rating can change over time as the injury changes.

Disability payments under the VA system are not contingent upon service time or rank as they are in the DoD system. Instead, the severity of the disability will be the determining factor. To qualify for a monthly payment under disability compensation, an individual must be rated at least 10 percent. The VA issues a compensation table annually; this dictates the amount that each disability group will receive. In addition, veterans with a disability rating of at least 30 percent may receive more money depending on the number dependents living with them. VA disability payments are not taxable.

Individuals who qualify for VA Disability Compensation may also qualify for Special Monthly Compensation (SMC), which is a program to help those with severe injures (such as amputations, blindness, ect.). These individuals may receive money in addition to the standard disability compensation payments. These amounts will be calculated by taking into account the costs of care and other special needs.

The severity of a veteran’s unemployability may also impact the amount of compensation above and beyond that offered through the basic disability compensation program. The Individual Unemployability (IU) program allows payments of total disability (equivalent to that offered to a veteran rated at 100 percent disabled) to veterans:

- who are rated at least 60 percent for a single injury, and cannot work as a result of their service-connected disability, or

- veterans rated at least 40 percent for a single injury, with a 70 percent overall rating, and who cannot work as a result of the injuries.

Veteran’s who do not meet these requirements and who cannot work should contact the VA anyway, to determine if they will make an exception for you. While such an exception is not guaranteed, the VA has been known to grant them. The veteran who believes that an exception may be in order is advised to seek legal assistance to ensure that his/her application is well-grounded.

For more information about how to apply for disability compensation, visit our content on How to File A Disability Claim. For more information on the VA Disability Compensation visit the VA website.

VA Disability Pension

The VA Disability Pension is designed for wartime veterans who are 65 years old or older and meet certain income requirements, or who are considered permanently disabled from a non-service related condition. Compensation amounts are determined based upon need.

To qualify for a VA Disability Pension a veteran must:

- Have been discharged under other than dishonorable conditions;

- Be totally or permanently disabled, or aged;

- Have served at least one day during a period of wartime and a minimum of 90 days on active duty, or served for at least 24 months if that veteran enlisted after 1980; and

- Meet the required income minimum.

For those veterans who qualify under the above criteria, payment is calculated by finding the difference between the veteran’s yearly family income and the costs of his medical condition. The total number of dependents will be taken into consideration. Income from welfare and other needs-based programs are not considered in determining a family's yearly income. However, other family members' income and SSDI income will be counted.

In addition, veterans may receive benefits from both the VA Disability Compensation Program and the VA Disability Pension simultaneously. This may occur were the disability compensation is at a level that remains below the income maximum of the VA Pension Program. Thus, VA Disability Compensation is also considered in calculating a veteran’s yearly family income for purposes of the VA Pension.

While the VA is designed to be user friendly, and claims can be made on your own, you may wish to receive assistance in applying for VA benefits. For more information about the application process and where you can get help visit How to File a Disability Claim. To apply on your own submit a VA Form 21-526 with proof of eligibility, or apply online. For more information visit the VA’s Disability Pension Page.